Forex Trading Methods Using a Three River Bottom Bullish Candletick

After previously we discussed and sharing the forex trading method using the "Bullish Meeting Lines" candlestick pattern, in this article We will discuss candlestick patterns that still have an intermediate level of precision i.e. the "Bullish Candlestick three River Bottom" pattern. The Three River Bottom Bullish Candlestick Pattern tells us that there is a trend change in the market. This trend change occurs from the trend (Bearish) towards the trend (Bullish). What this means is that it signals a buy signal with great profit potential.

As we said that the three River Bottom Bullish Candlestick pattern has an intermediate level of accuracy. Therefore, we recommend waiting for confirmation before we act on making a purchase. In some methods that we have ever shared about candlestick patterns that have an intermediate level of accuracy, We always recommend waiting for confirmation in advance before making a share purchase.

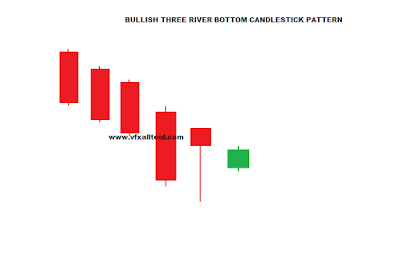

For you to better understand how this three River Bottom Bullish Candlestick pattern is a signal that a price reversal is happening, let's take a look at the following image below:

Three River Bottom Bullish Candlestick Pattern

|

| Three River Bottom Bullish Candlestick Pattern |

On the first day, there was a long-stemmed red candlestick. Meaning this tells us that the candlestick is Bearish and still passed on his dominance. Of course, we are a trader who will discriminate that the Bearish candlestick will continue to dominate in the following days. And it seems that this prediction is true on the second day because the Bearish candlestick still comes out as the winner.

Then on the second day, We see that there is a red candlestick that has a short stem with a long lower tail, or it can be called a candlestick (hammer). This candlestick tells us that at the beginning of the price battle, there was a strong counterattack from the Bullish candlestick. The candlestick managed to hit the Bearish candlestick quite far. Then it was seen, the Bearish candlestick began to strike back, and succeeded rampant forward with significant force.

But, at the end of the price battle, the Bullish candlestick again launched a strong attack. Until the Bearish candlestick pulled back quite a distance even though not to the point where it was originally. In fact, the second day's candlestick tells us that the Bearish candlestick is weak while the Bullish candlestick is strong. On the third day, we see a green candlestick that has a short bar. It means that this candlestick tells us that the Bullish candlestick is finally won the price battle.

Although the candlestick has not dominated very much, at least it has been confirmed that the Bullish candlestick is stronger than the Bearish candlestick. Get it is predicted that the Bullish candlestick will continue to be strong until it will dominate the price meeting on the next day. But, to further ascertain the information We have to wait first until the information is confirmed that the Bullish candlestick has completely dominated the price. The following is the description from a confirmation of a Bullish the River Bottom candlestick pattern:

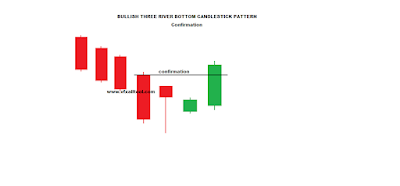

Confirmation of three River Bottom Bullish Candlestick Pattern

|

| Confirmation of the Three River Bottom Bullish Candlestick Pattern |

From the confirmation picture of the Bullish three River Bottom candlestick pattern, We have added a long-stemmed green candlestick and a confirmation line that has Black. From the picture, we can see together that the green candlestick penetrates above the confirmation line. This tells us that candlestick

Bullish has really been able to dominate the price of a market. From the information, it has been

confirmed that the Bullish candlestick is now much stronger than the candlestick Bearish. The stock price will continue to rise, and it is a good time for Us to make a purchase.

Conclusion: The Three River Bottom Bullish Candlestick Pattern is a candlestick pattern that tells us that there is a change in price direction or a downtrend towards an upside. This candlestick pattern has an intermediate precision. It is recommended to wait for confirmation first before making a purchase if you have obtained price information will go up.

Disclaimer: The trading methods or signals available are present for informational purposes only and are in no way an action guide. Site and program owners do not accept any responsibility for using the information provided on the website and in the programs that have been created, as well as for any errors. Information on this site does not constitute a public offering.

Post a Comment for "Forex Trading Methods Using a Three River Bottom Bullish Candletick"