Forex Reversion Means Trading - Is It A Profitable Strategy For Traders?

In this article, we will explain the phenomenon of mean reversion in stock prices or Forex. Not a few trading strategies aim to exploit one of two phenomena prevailing in financial markets - mean reversion or momentum.

What is Average Reversion?

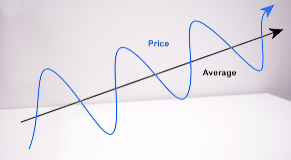

The financial concept of average return is better known as "mean regression," which refers to the probability of a data set deviating from back to average. This is often referred to in mathematical terms. The average return strategy has the underlying assumption that historical averages have significance.

Yet not a few average return traders do not believe that historical averages have any significance. Though this point is a convenient reference. For example, if a stock is three standard deviations from the 10-day average, it is an indicator that it has just made a very large upward movement. And there is also a signal with great potential.

Directional Average Return

A directional average return strategy involves projecting a directional price movement in a particular security. For example, if the stock Apple is down two standard deviations from the 90-day linear regression, we might expect a net return in the situation lean positive.

Relationship Means Reversion

Most professional average return traders do not trade directionally. Instead, they trade relations between securities. A simple example is a statistical arbitrage between two sharing classes. In most cases, both stocks have nearly the same intrinsic value and should be traded at the same value.

Types of Targeted Average Return Strategy

- Technical Indicators

- Linear Regression

Post a Comment for "Forex Reversion Means Trading - Is It A Profitable Strategy For Traders?"